Citizenship by investment is a process whereby wealthy individuals can obtain a second citizenship very quickly in exchange for an investment or donation.

To encourage Foreign Direct Investment and to attract high net worth individuals to settle and do business, many countries have launched their investment programs to enable rich people secure citizenship in these countries. The investment schemes are termed as Citizenship By Investment (CBI) and Residence By Investment (RBI), while different names have been assigned to the schemes by the countries. Individuals may be interested in these schemes for a number of legitimate reasons.

Such a scheme promotes rich people to invest in these countries sums amounting to a few million dollars (or) Euros to obtain permanent residency (or) temporary residency (or) citizenship. This might also enable the rich persons to stash their assets in these foreign countries and pay negligible tax to evade higher tax burden in their original jurisdictions as the income tax rates in CBI/RBI countries are much below 10%.

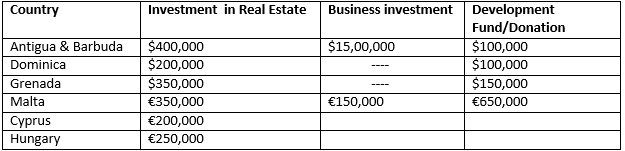

The following table provides the details of investments to be made by the high network individuals in any one of the avenues listed below to obtain residential status in the specified country.

These individuals also enjoy visa free travels to as many as 150+ countries and enjoy reduced tax burden on the income.

Though the schemes per se are a financial boon to the countries that offer them as they are intended to promote business growth, there are multiple instances of misusing these avenues to evade taxes and commit financial indiscipline in the repayment of debt to the Banks and Financial Institutions in the home country due to diversion of funds.

The opaque nature of these schemes makes them vulnerable to corruption – e.g. an individual with residency in an EU member state can travel across much of the bloc without additional paper work. Those with citizenship can work and travel anywhere within the EU. Elements seeking benefits under such schemes heighten the risks to security and open the door to money laundering and tax evasion across the EU bloc.

Organization for Economic Co-operation and Development (OECD) has identified such investment schemes promoted by some countries to enable rich people obtain citizenship in that country without insisting on their physical presence in the country at least for a minimum period of 90 days in a year.

Information released in the market place and obtained through the OECD’s Common Reporting Standard (CRS) public disclosure facility highlights the abuse of CBI/RBI schemes to circumvent reporting under the CRS.

Potentially high-risk CBI/RBI schemes are those that give access to a low personal income tax rate on offshore financial assets and do not require an individual to spend a significant amount of time in the location offering the scheme.

It looks like sale of Citizenship as a commodity for a price without ethos!!! Hence time has arrived for a review of such incentive schemes by the respective local authorities.

Some individuals intending to circumvent the CRS via CBI/RBI schemes might attempt to avoid income tax on their offshore financial assets in the CBI/RBI jurisdiction and without fundamentally changing their lifestyle by leaving their original jurisdiction of residence and relocating to the CBI/RBI jurisdiction. Such people may evade tax by claiming residency in these countries offering CBI/RBI schemes with low tax rates and thereby avoid furnishing the details of tax residency in the original jurisdiction.

OECD has advised the Financial Institutions (FI) not to rely on the self-certification or Documentary Evidence, if the FI knows or has reason to know, that the self-certification or Documentary Evidence is incorrect or unreliable. The FI may also verify the results of the OECD’s CBI/RBI risk analysis. Wherever doubt exists as to the tax residency of an Account Holder (or) Controlling Person, it should take appropriate measures to ascertain the tax residency of such persons.

In such instances, FIs may consider raising further questions, including:

- Did you obtain residence rights under a CBI/RBI scheme?

- Do you hold residence rights in any other jurisdiction(s)?

- Have you spent more than 90 days in any other jurisdiction(s) during the previous year?

- In which jurisdiction(s) have you filed personal income tax returns during the previous year?

The responses to the above questions will help in ascertaining whether the provided self-certification or Documentary Evidence is incorrect or unreliable.

After ascertaining the correct tax residency status of the Account Holder (or) Controlling person, the FI may report the CRS status to the respective jurisdictions accordingly.

But a review of these programs by the respective jurisdictions is a necessity, given the risks associated with such investments, to arrest the abuse of such schemes.