Needless to say, Common Reporting Standard (CRS) Compliance by Financial Institutions is a statutory requirement.The regulation encompasses Due diligence completion and reporting of Financial Accounts of Individuals, Entities and Controlling persons of the Entities with the foreign resident status of a CRS jurisdiction.

The procedure for Due Diligence of Individuals is relatively simple compared to that of Entities as it requires several checks to be carried out before arriving at the reportable status of the entity.

This blog summarizes the rules/requirements for CRS Compliance of Entities:

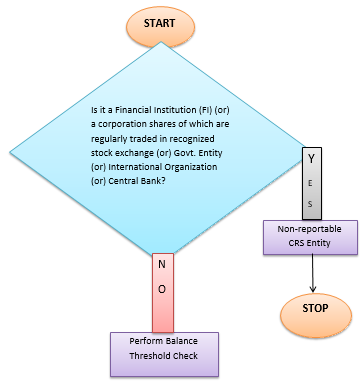

- Exempted Entities: If the entity is an exempted entity like Govt. Organization, International Organization, Publicly Traded corporate, local bank, Financial Institution, then the entity is not reportable. Remaining accounts have to undergo NFE Process.

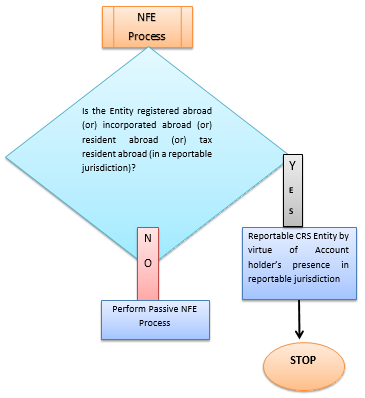

- NFE Process: Non-Financial Entity (NFE) has to be checked for residency status. If the Entity is registered abroad (or) incorporated abroad (or) resident abroad (or) tax resident abroad (in a reportable jurisdiction), then the Entity is reportable CRS entity by virtue of the Entity account holder status, subject to threshold balance.

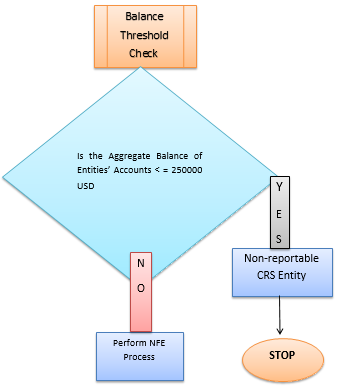

- Threshold Balance Check: FI has to perform Threshold Balance check to eliminate accounts with threshold balance < = 250000 USD. If the aggregate threshold balance is < = 250000 USD, then the entity is not reportable under CRS. For the remaining accounts, where residency status is only domestic, Passive NFE process has to be done.

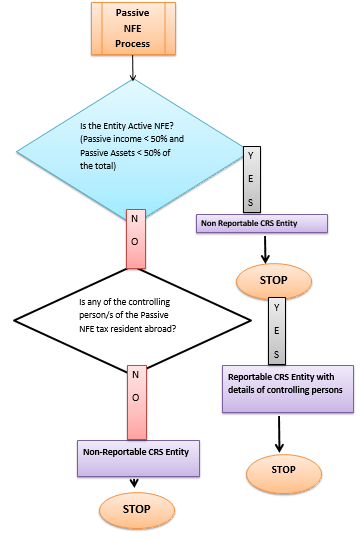

- Passive NFE Process: If the passive income of the entity is more than 50% (income from financial assets) (or) if the financial assets deployed by the Entity is > 50% of the total assets deployed, then the entity is a Passive NFE. Other-wise, the entity is Active Non-Financial Entity.

- Active NFE with only domestic resident status is not reportable under CRS

- Passive Financial Entity with domestic resident status is reportable only when any of the controlling person’s tax residency is abroad within the CRS reportable jurisdiction.

The following flowchart shows the logical flow of rules in deciding the reportable status of the Entity and the Controlling persons of the entity:

To ascertain the tax residency status, the Reporting Financial Institution has to obtain Tax residency details like Tax Identification Number (or) Alternative documents with Issuing country details for the entity and controlling persons identified as likely CRS reportable entities based on the indicator (indicia) details available in Bank’s records for the entity and the controlling persons of the entity (or) based on other records available with the Bank (or) based on the publicly available information.